Condo Insurance in and around Bristol

Here's why you need condo unitowners insurance

Quality coverage for your condo and belongings inside

- Pennsylvania

- New Jersey

- Delaware

- Maryland

- Bucks County

- Montgomery County

- Langhorne, PA

- Newtown, PA

- Yardley, PA

- Morrisville, PA

- Bristol, PA

- Croydon, PA

- Levittown, PA

- Ambler, PA

- Chalfont, PA

- Doylestown, PA

- Horsham, PA

- Ft. Washington, PA

- Philadelphia, PA

- Maple Glen, PA

Your Search For Condo Insurance Ends With State Farm

The life you hold dear is rooted in the condo you call home. Your condo is where you slow down, relax and laugh and play. It’s where you build a life with your favorite people.

Here's why you need condo unitowners insurance

Quality coverage for your condo and belongings inside

Put Those Worries To Rest

You want to protect that important place, and we want to help you with State Farm Condo Unitowners Insurance. This can cover unexpected damage to your personal property from a covered peril such as theft, hail or fire. Agent Jeffrey T Hughes can help you figure out how much of this awesome coverage you need and create a policy that has what you need.

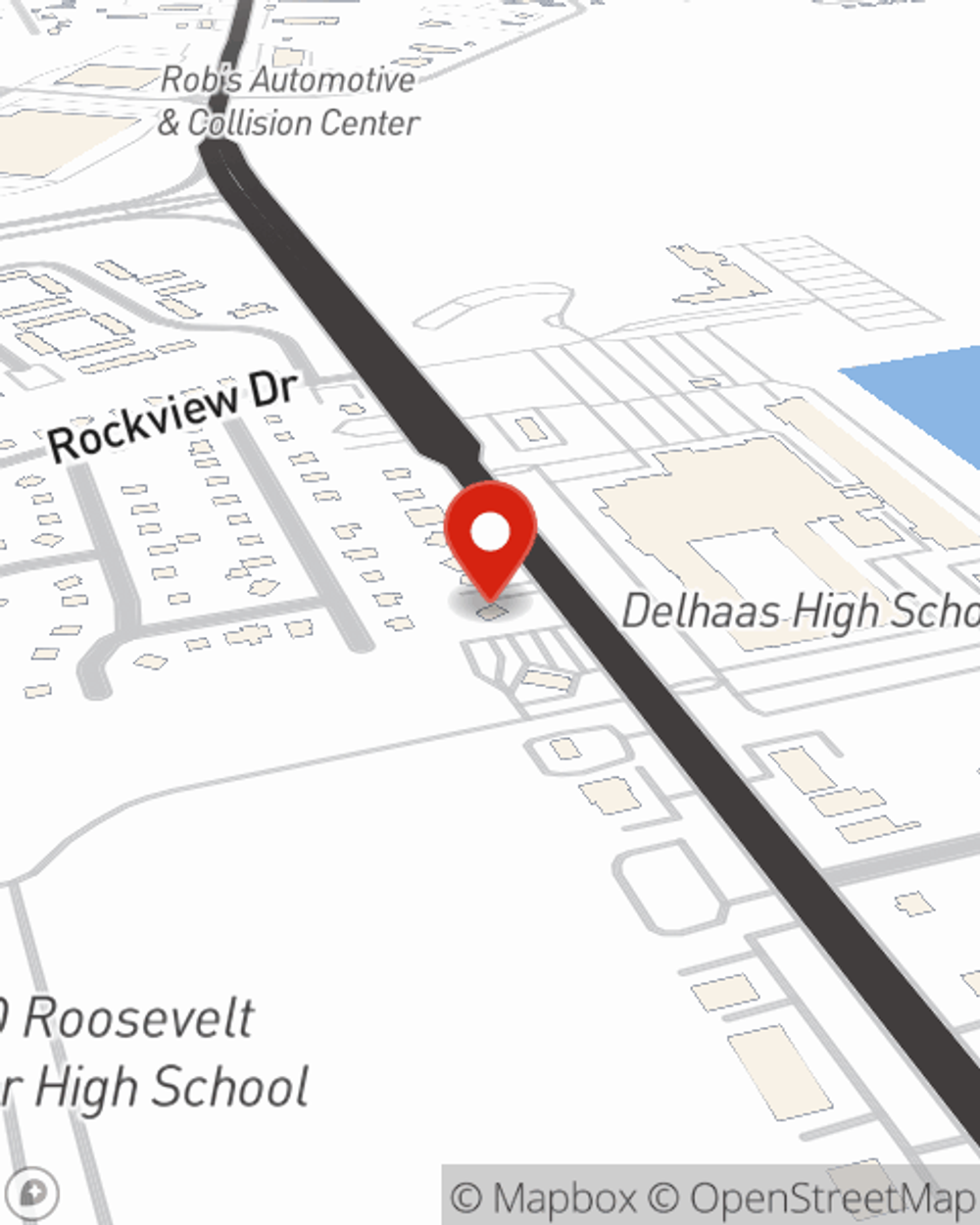

When your Bristol, PA, condo unit is insured by State Farm, even if life doesn't go right, State Farm can help protect your one of your most valuable assets! Call or go online now and discover how State Farm agent Jeffrey T Hughes can help meet your condo unitowners insurance needs.

Have More Questions About Condo Unitowners Insurance?

Call Jeffrey T at (215) 757-6900 or visit our FAQ page.

Simple Insights®

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Jeffrey T Hughes

State Farm® Insurance AgentSimple Insights®

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.